Artificial intelligence (AI) continues to be a major area of interest in fintech, according to Pulse of Fintech H1 ‘24. More and more companies are investing in this technology, primarily to improve operational efficiency and reduce costs. However, despite the growing demand for AI in the banking sector and in the financial industry, adopting AI still presents challenges, mainly because it’s difficult to find the right experts.

With 17 years of experience in recruiting the best middle to C-level specialists in IT, we at INDIGO Tech Recruiters know exactly how to find the kind of team a business needs to embrace innovation. In this article, we’ll guide you through the most common use cases of AI in fintech and the specialists and expertise required to implement AI in your fintech product.

AI in fintech process automation

According to the US-based independent investment management company Invesco, ensuring the efficiency of operations through machine-learning automation will soon become the norm for the financial industry. In 2020, Invesco reported that 51% of fintech companies had already implemented AI to streamline processes. How does this work?

Here are a few examples of how implementing AI in financial technologies can automate operations:

- Accelerated transaction processing: Using AI, financial organizations can speed up transaction processing and verification, leading to faster payment approvals and fewer errors.

- Fraud detection and prevention: AI-powered systems can detect suspicious activity in real time and flag potentially fraudulent transactions before they cause damage.

- Credit scoring and loan approvals: Traditionally, credit risk evaluation involves manual review. However, with AI, your system can analyze a broad range of financial data, such as a customer’s social behavior and payment history, to assess creditworthiness faster and more accurately.

- Customer support automation: AI chatbots and virtual assistants can free your team from answering hundreds of routine customer inquiries. Moreover, chatbots learn from interactions to provide more personalized and accurate responses over time.

Today, many companies have adopted AI to automate fintech processes. For example, one of the most famous online payment systems, PayPal, uses AI to spot potential fraudulent activities. It relies on AI-driven filters with machine learning capabilities to assign risk scores to every transaction, enhancing the precision of fraud detection.

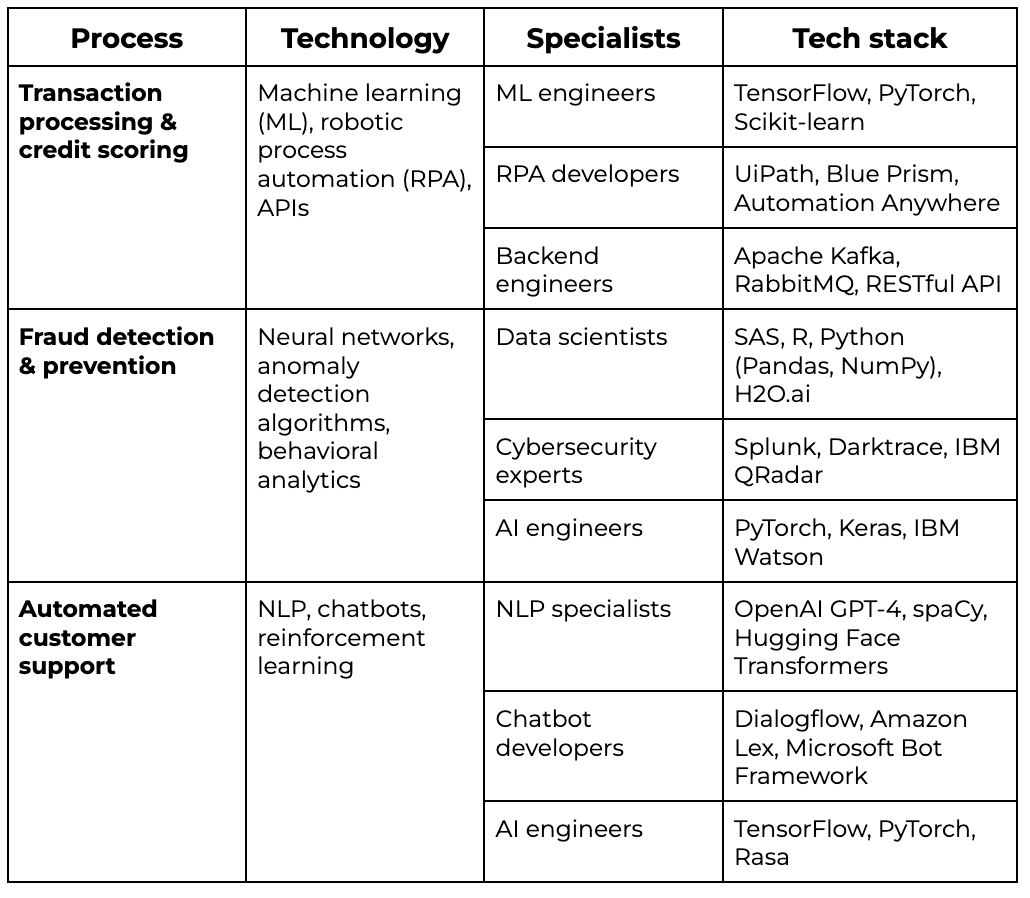

If you plan to use artificial intelligence for financial services, the first step is gathering the right team. To help, we created a table of the technologies, specialists, and tech stacks you’ll need to automate different processes.

Finding the right fintech specialists can be challenging and time-consuming to do on your own. To ease the process, you can always reach out to INDIGO Tech Recruiters, and we’ll help you find the best talent for any project you have. Now, let’s move on and explore other AI applications in fintech.

Data analytics with AI

Fintech largely relies on big data to achieve personalized services, accurate risk assessment, and better decision-making. Also, big data analytics can help build better fintech solutions and predict their impact, according to some research.

What’s the role of AI in data analytics? With its ability to quickly analyze massive datasets, this technology allows you to identify patterns that would be difficult for humans to detect and extract valuable insights. As a result, financial companies can benefit from:

- Accurate forecasts: By analyzing historical data, AI can predict future trends and help fintech companies make winning strategic decisions.

- Customer insights: AI-based analysis of customer behavior, transaction history, and customer feedback lets financial institutions personalize their offerings and, thus, improve customer satisfaction.

- Market trend analysis: AI can process large amounts of information about market indicators in real time, enabling fintech solutions to provide deep insights into market trends and meet growing market needs.

- Risk mitigation: AI-based tools can conduct a deep analysis of various financial data points and identify risks like fraud, data breaches, and loan defaults almost immediately.

So, AI helps fintech take data analytics to the next level, making it faster, automated, and more accurate. Some financial companies have already witnessed the benefits of data analysis with AI.

A great example is how Bud Financial, a data intelligence platform, uses AI to help financial companies personalize their offerings and create more powerful marketing campaigns. The platform contains a so-called “insights engine” that generates insights from customer data and highlights those that can be quickly and easily acted upon.

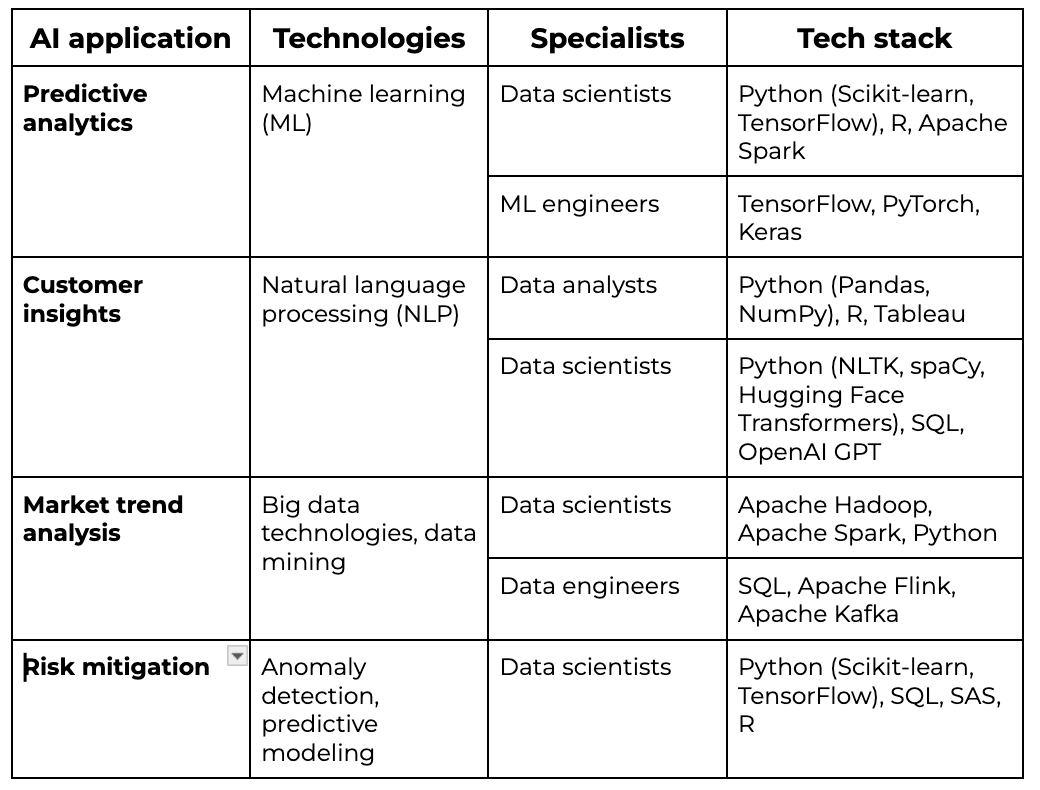

What specialists are required to implement AI-powered data analytics in fintech? Here’s a brief overview:

At INDIGO Tech Recruiters, we have the expertise, resources, and capabilities to find the perfect match for your fintech project. Just contact us, and we’ll staff you with the best talent.

AI-powered improvement of customer experience in fintech

James Sanchez, a customer success leader of LeanLaw, says that AI will be the main driver in improving customer relationships. This especially applies to millennials, Gen Z, and Gen Alpha customers who prefer self-service over traditional channels, so building meaningful relationships with them involves making this option convenient and efficient. However, self-service is just one of many ways AI can improve customer experience. Others include:

- Personalization: It makes customers feel understood and valued. By analyzing individual customer data, preferences, and behavior, AI allows companies to create tailored financial products and services. For example, AI can suggest offering lower interest rates on personal loans to trustworthy customers.

- 24/7 customer support: AI-powered chatbots and virtual assistants can provide assistance anytime and anywhere to help customers resolve issues promptly without the need to contact a human representative.

- Proactive engagement: AI-powered software can predict customer financial patterns based on historical data and help them handle day-to-day money tasks. For example, such tools can send reminders for bill payments or suggest investment opportunities tailored to their personal financial goals.

By improving customer experience, AI technologies help companies foster loyalty, which translates into better positioning in the market. For instance, in 2018, Bank of America launched Erica—an AI-driven virtual assistant. Erica replies to customers in less than 44 seconds on average. It monitors their subscriptions, provides insights about their spending behaviors, updates them on important events, and even has a great sense of humor.

“Erica is a great example of applied innovation in language processing and predictive analytics to deliver a valuable and empowering client experience,” says Hari Gopalkrishnan, CIO and Executive of Consumer, Business & Wealth Management Technology at Bank of America.

“Erica is a great example of applied innovation in language processing and predictive analytics to deliver a valuable and empowering client experience,” says Hari Gopalkrishnan, CIO and Executive of Consumer, Business & Wealth Management Technology at Bank of America.

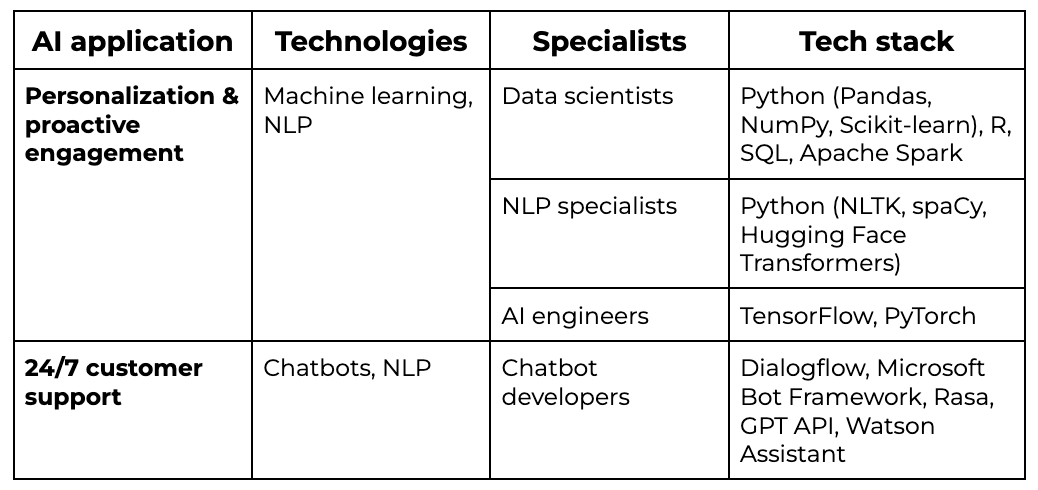

Yet, using AI to improve customer experience in fintech requires a strong understanding of both the technology and the industry. Here’s a brief table listing the technologies, specialists, and tech stack you may need for different use cases:

If you want to find AI specialists to improve the customer experience of your fintech product, keep in mind that INDIGO Tech Recruiters has more than 300,000 top tech professionals in its talent pool.

Increased productivity and reduced costs with AI

Integrating AI tools into financial products positively impacts your bottom line by enhancing efficiency and cutting operational expenses. Let’s look at some of the ways AI can do this:

- Automation of routine tasks: By automating repetitive tasks such as data entry, transaction processing, and customer support, AI reduces your employees' workload. This means you’ll need less staff to do the same job your full staff did prior to implementing AI.

- Better and faster decisions: AI's ability to analyze vast amounts of data far beyond human capacity enables smarter, more informed decision-making at all levels—from individual loan approvals to market expansion strategies. This results in fewer risks and better profitability.

- Cost optimization: AI systems can detect inefficiencies in your core operations and suggest ways to resolve them, for example, through better resource allocation or staff distribution. This leads to cost reductions in both infrastructure and human resources.

While AI implementation may seem expensive, its long-term effects can bring fintech companies much more money. And the next real-world case is proof of that.

Lemonade, America’s top-rated insurance company, implemented AI bots in their system, and today, half of their claims are paid within seconds, without any human intervention. This allows them to keep their rates as low as $5 a month. Thus, they reduced operational expenses but not at the cost of customer experience. They actually achieved both—lowered expenses and gave customers a better experience. Notably, thanks to AI, Lemonade reported a 115% increase in revenue in Q1 of 2023, with only a 4% increase in operating expenses.

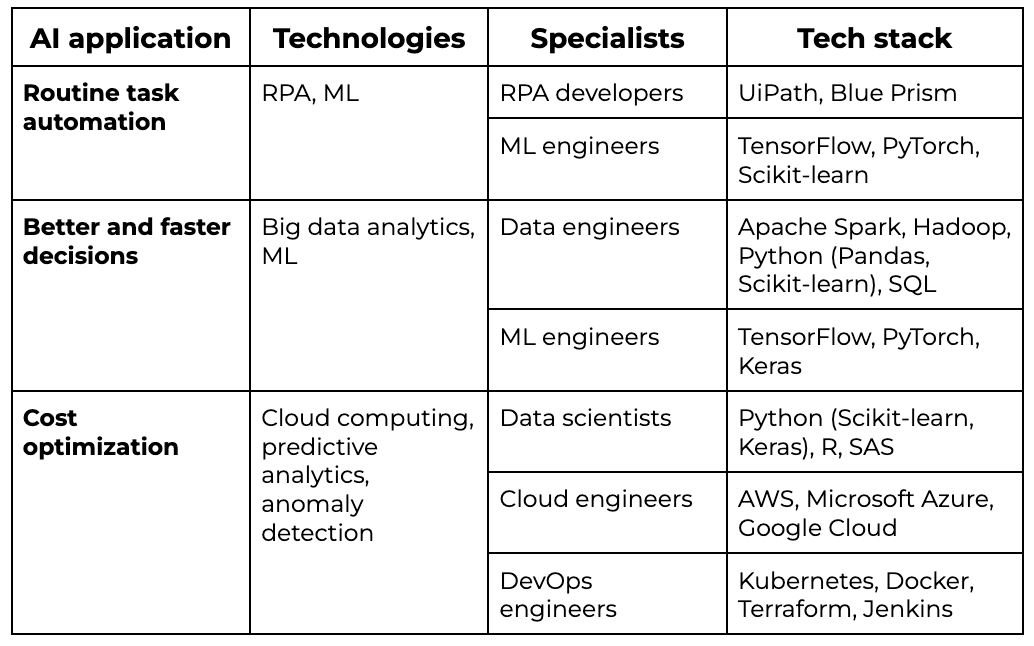

What team and technologies do you need to achieve the productivity and cost benefits of AI? Here’s an overview:

If you’re interested in hiring any of these professionals, contact INDIGO Tech Recruiters, and we’ll find them for you within a few weeks.

Wrapping-up

Data and real-world use cases have shown that using artificial intelligence for financial services leads to increased team productivity, better data analysis, faster operations, improved customer experience, and reduced costs. And that’s definitely worth investing in.

Yet, implementing AI in fintech requires specific expertise, which may not be available in-house or easily found outside your company. That’s why we at INDIGO Tech Recruiters help fintech companies staff their projects with the best talent who possess all the necessary skills and knowledge. So, whether you need a few specialists to complement your tech team or to assemble a whole new team, contact us, and we’ll assist you with all of your talent search requests.

Success!

Success!